David Murrin: The Fed Needs to Own Up to What it has Blown Up

Tom welcomes back global forecaster and author David Murrin. David believes there is a risk of significant conflict in the Asian region including Korea and Taiwan. China is gaining knowledge of war and the usefulness of drone technology. The West is essentially at war with Russia, but the level of collective delusion from Western leaders is concerning.

The United States has been in decline since the beginning of this century. We’re seeing more liberal policies, and we’re seeing things unravel socially and politically.

David discusses how China has shifted policy to become independent from the West. The consequences could be severe because the West is far behind in manufacturing. China is trying to become a consumer nation, and currently, they are using excess manufacturing capacity for consumer goods and weapons.

David explains the differences between lateral and linear ways of thinking. We’ve had an abundance of linear thinkers who is less flexible but useful in times of stability. The truth is the West is declining because of this linear takeover of thought. What is needed today is greater understanding. The West’s institutions are dominated by linear thinkers whereas China is thinking laterally. Britain is the only country that has a chance of becoming more lateral soon.

The world of finance is dominated by linear thinkers, and we see how that approach is working with inflation.

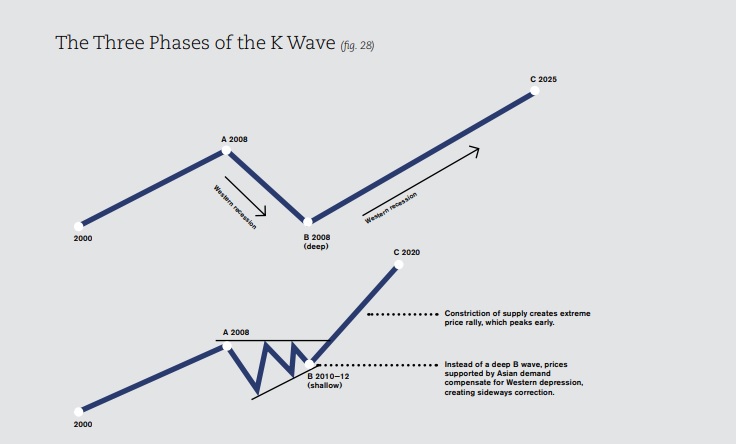

Kondratieff cycles are composed of 52-year cycles that move from peak to bottom over 26 years. This cycle started around 2000, and he believes a collapse in demand is imminent . Equities will be chewed up, and the next phase will be more inflation and higher commodities. There will be a pause with inflation followed by another surge. He believes hyperinflation is in the cards. Whatever has worked for the past twenty years is unlikely to do so in an era of money printing.

He believes the dollar will sell off and enter a final declining cycle. The dollar is going to lose favor against the Euro in a profound way as capital flees.

There are numerous problems with commodities and a lack of capital investment in the sector. Europe needs to do far more to manage its energy resources. They haven’t taken a strategic view of energy, and now they face the consequences.

We’re looking at a collapse of a magnitude that is hard to comprehend as a hundred years of policies correct.

He explains the differences between the debts of the United States and China. The U.S. is far more vulnerable than China as China has invested in actual production capacity.

Lastly, he explains the psychology of markets and the importance of price. Investors need to analyze both their successes and failures because they may have just gotten lucky.

Time Stamp References:

0:00 – Introduction

1:19 – American Hegemony

4:56 – Eastern Planning

7:14 – Economic Consequences

10:36 – Lateral Vs. Linear

15:47 – Kondratieff Cycles

21:18 – Alpha & Beta Models

25:24 – Dollar Outflows & Rates

29:42 – Resource Underinvestment

31:26 – Doomsday Bubble

34:45 – Debt Jubilee?

40:00 – Commodities & Inflation

41:24 – China Vs. U.S. Debt

43:25 – Protecting Yourself

44:50 – Market Psychology

50:33 – Thinking Clearly

53:05 – Wrap Up

Talking Points From This Episode

- David’s assessment of the risks from China and their increasing geopolitical and militaristic influence.

- Types of thinking and why the West is dominated by linear thought.

- Kondratieff waves and why the dollar is in for another leg down.

- Price and the major flaws with fundamentals.

Guest Links

Twitter: https://twitter.com/GlobalForecastr

Website: https://www.davidmurrin.co.uk/

David Murrin began his unique career in the oil exploration business amongst the jungles of Papua New Guinea and the southwestern Pacific islands. There, he engaged with the numerous tribes of the Sepik River, exploring the mineral composition of the region. Before the age of adventure tourism, this region was highly dangerous, very uncertain and local indigenous groups were often hostile and cannibalistic. David’s work with the PNG tribespeople catalyzed his theories on collective human behavior.

In the early 1980s, David embarked on a new career, joining JP Morgan in London. Watching his colleagues on the trading floors, he quickly identified modern society also behaved collectively. He was sent to New York on JPMs highly rated internal MBA equivalent finance program. Once back in London, he traded FX, bonds, equities, and commodities on JPMs first European Prop desk. In 1991, he founded and managed JPMs highly successful European Market Analysis Group, developing new behavioral investment techniques which were utilized to deploy and manage risk at the highest level of the bank.

In 1993, David founded his first hedge fund, Apollo Asset Management, and, in 1997, co-founded Emergent Asset Management as CIO. His primary role was overseeing trading across all fund products as well as being particularly active in the firm’s private equity business. He co-founded Emvest, Emergents African land fund, in 2008 and acted as its Chairman until its sale from the group in 2011. In addition, through Emergents Advisory Business, David was responsible for the critical fund-raising for Heritage Oil, allowing it to expand significantly by investing in its Uganda exploration program. He took full control of Emergent in 2011, combining his management of the Geomacro fund with the role of Chief Executive Officer until 2014.

David has been described as a polymath and his career of more than three decades has been focused on finding and understanding collective human behavioral patterns including deep-seated patterns in history and then using them to try and predict the future for geopolitics and markets in today’s turbulent times. He has a remarkable track record.

Davids’s advisory and future trends speaking are based on his direct investment experience combined with a framework that can be used to explain and qualify decisions within an investment team, aid risk assessment and reduce biases in collective investment decisions.

In the desire to share his observations and predictive constructs, David has written four books.