Gianni Kovacevic: The Copper Bull Market is Only Just Starting

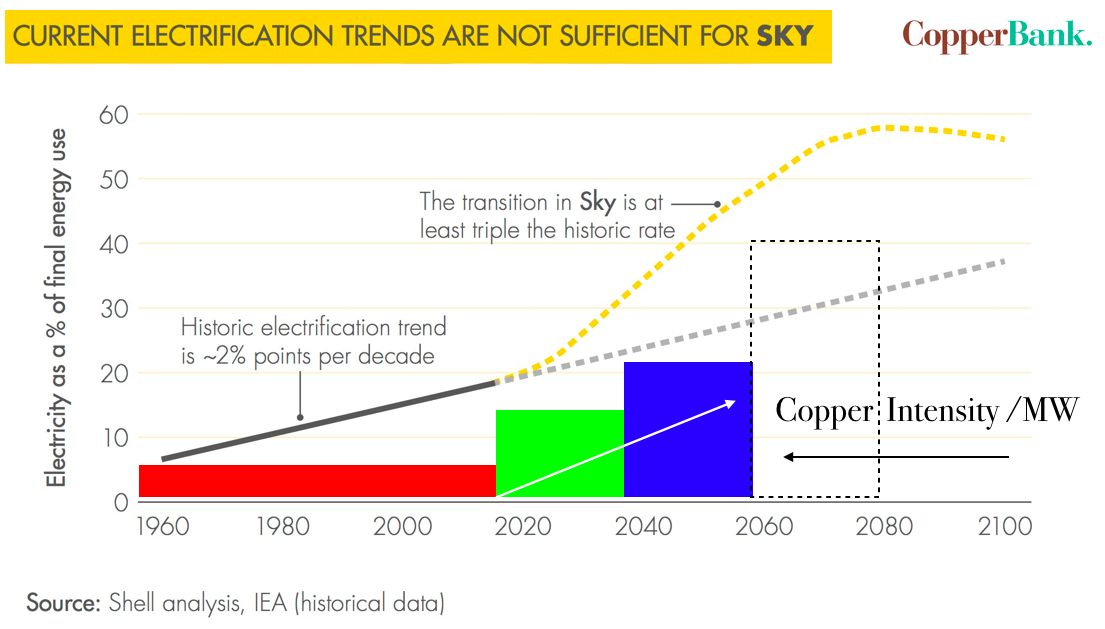

Gianni drove an electric car across America and Europe in order to demonstrate the practicality of such vehicles. He makes a compelling case that the worlds energy needs in the coming years will move rapidly towards electrification. This demand requires enormous amounts of copper and aluminum. Many things that aren’t electric today like buses, trucks, and utility vehicles are all going to become electric. Wind farms and solar applications will continue to drive copper and aluminum demand.

Copper exploration and mines require significantly higher prices to be incentivized. Keep in mind that few exploration discoveries were made with significant investment in the last cycle and what is undeveloped is just uneconomical low-grade deposits. Above ground supplies of copper seem to be dwindling. The price of copper has to go higher since there is no other way to bring on more supply.

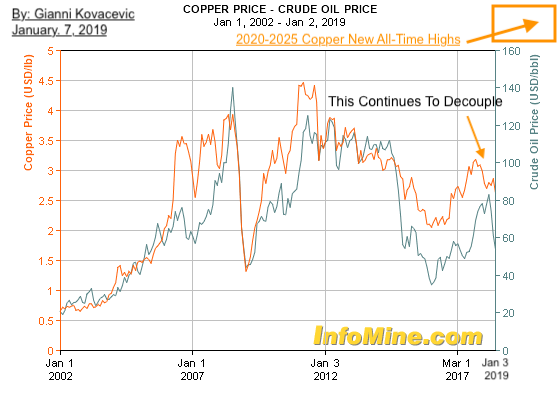

Copper has not yet had a renaissance, for the next two to three years there is only one major mine coming online. Many investors and governments have failed to notice that half of all world copper supply comes from Peru and Chile. When a supply deficit demonstrates itself, or a mine has issues only then will traders move the price.

Today 19% of energy usage is via electrification, and that will move towards 50% in the coming decades. We are looking at nearly a 3x increase in the electrification of the world in a much shorter period than it took us to reach our current level.

Gianni also discusses a speculative play with helium and why there could be an opportunity with that overlooked resource.

TimeStamp Reference:

1:30 – The case for EV and copper demand.

3:00 – Copper development and lack of exploration.

3:40 – Copper is moving contrary to oil.

7:00 – Majority of undeveloped copper is low-grade.

8:00 – Few investors are paying attention to supply/demand.

10:00 – World energy electrification demand and growth.

14:30 – Optionality with copper and opportunities in helium.

Talking Points From This Week’s Episode

• Investors should be very optimistic about the demand growth for copper.

• Under-investment in the copper space.

• Few discoveries and low supply levels for copper and many new users.

Gianni Kovacevic is Executive Chairman (Director) for Copper Bank Corporation. He is a renowned expert on incumbent energy systems and a sought-after strategist in the divestment movement. He has invested over 20,000 hours of research and experience in the analysis of the natural resource sector. His specific expertise on copper markets has brought him to lecture at institutions and think-tanks around the world. An avid proponent of realistic environmentalism, he is frequently interviewed by the media and his new book, “My Electrician Drives a Porsche” was published in 2016 and is available in multiple languages at booksellers everywhere. Mr. Kovacevic is a graduate of electrical studies from The British Columbia Institute of Technology, fluent in English, German, Italian and Croatian, and he is a founding member of the CO2 Master Solutions Partnership and a co-founder of CopperBank.