Egon von Greyerz: Global Debt Implosion Coming

Tom welcomes a new guest to the show Egon von Greyerz. Egon is Founder and Managing Partner of Matterhorn Asset Management AG based in Switzerland.

Egon discusses how today’s events aren’t new; we are in a pattern that repeats throughout history. Governments love to spend more than they receive in revenue, and no currency has ever survived. Deficits have been nearly non-stop since 1930, and often an unrelated trigger can cause the crisis.

Central banks are creating worthless money out of thin air only because people believe it has value. Today, we are in the euphoric final phase of the monetary system as asset bubbles get inflated. Market risks today are far worse than they were in 1929 because this time, they are global. Central bankers will do whatever is necessary to support the system, but it’s a losing game. It remains possible that stock markets double from here, but it’s also likely that gold and the Dow will meet at some point.

Egon is concerned that we will enter a dark period of decline and that only once we are through it will the historians label it. Debt can’t be fixed with more debt; however, central banks and governments don’t seem to understand this fact. Hyperinflation always arises due to currency debasement and collapse, and eventually, interest rates must rise.

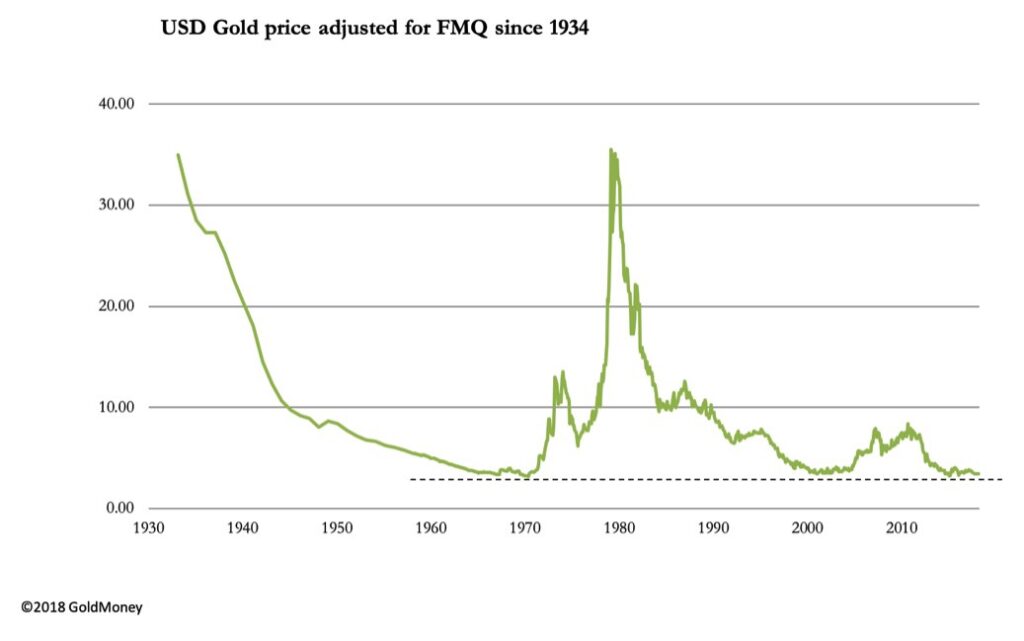

Gold today is at the same cheap levels of 1971 and 2000 compared to the total US money supply. He cautions, “Don’t measure your net worth against something that has no intrinsic value.”

We’ve reached the point where decline is inevitable for the west. Lastly, he discusses their ultra-secure private gold vault in Switzerland that is the largest in the World.

Time Stamp References:

0:00 – Introduction

0:45 – Central banks have lost control.

5:00 – Stages of a crisis.

6:45 – Collapsing currencies and US Dollar.

11:20 – Global debt and systemic risks.

15:10 – Debt explosion and coming turmoil.

19:00 – Hyperinflation and derivatives.

25:50 – Chart, gold adjusted for US money supply.

31:30 – China’s role in the future.

35:20 – Switzerland mountain vault.

38:50 – Pensions, ETF’s and Physical.

Talking Points From This Episode

- History is repeating; no one holds gold.

- Perception of value and massive debts.

- Investors need to prepare.

- The World is nearing a challenging period.

- Why gold is incredibly cheap today.

Guest Links:

Website: https://www.goldswitzerland.com

Twitter: https://twitter.com/GoldSwitzerland

Gold Vault Video: https://goldswitzerland.com/inside-the-mountain-interview/

Egon von Greyerz is Founder & Managing Partner of Matterhorn Asset Management AG. He started Matterhorn Asset Management (MAM) in 1999 as a private investment company. From the very beginning, wealth preservation was an essential cornerstone of the company. In early 2002, they believed that financial and economic risk in the World was getting uncomfortably high. So that year, they made substantial investments in the physical gold market at $300 on average.

As gold started to rise in the early 2000s, demand for physical gold increased, and in 2005 they set up a regulated company in Zurich – Matterhorn Asset Management AG. A couple of years later, they formed GoldSwitzerland, which is the precious metals division of MAM.

Egon was Born with both Swiss and Swedish citizenship. His education was mainly in Sweden. He started his working life in Geneva as a banker and after he spent 17 years as Finance Director and Executive Vice-Chairman of Dixons Group Plc.

Since the 1990s, Egon has been actively involved with financial investment activities, including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of MAM, an asset management company based on wealth preservation principles. MAM is now the World’s leading company for physical gold and silver outside the banking system, directly owned by the investor. Their four vaults include the most immense and safest gold vault in the World, located in the Swiss Alps. Clients are High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds, and Trusts in over 75 countries.

Egon makes regular media appearances and speaks at investment conferences around the World. He also publishes articles on precious metals, the world economy, and wealth preservation.